After a few years of successful day trading, Umar Ashraf found himself looking for software to plan, track, and evaluate his trades.

But, he says, when he looked at the trade journaling products available about four years ago, he didn’t find any that fully met his needs. Ashraf wanted features to help him better evaluate the details of his trades, like running profit-and-loss data that would help him understand price fluctuations and risk over the course of, say, buying and selling a stock, not just how much he ultimately made or lost.

“it’s very easy for me to look at trades and say, ‘Oh, well, you know, I made $500, great,'” he says. “But when I go deeper, I’m like, ‘well, I was down three grand at one point. This is not really a good trade.'”

Ashraf decided to develop his own software package with features he and other day traders would want, at first working with an agency to handle the actual coding, since he didn’t have a background in software development. After some false starts led him to hire a team and bring the operation in house with himself as CEO, he created what’s now called TradeZella, a software package first launched in early 2022.

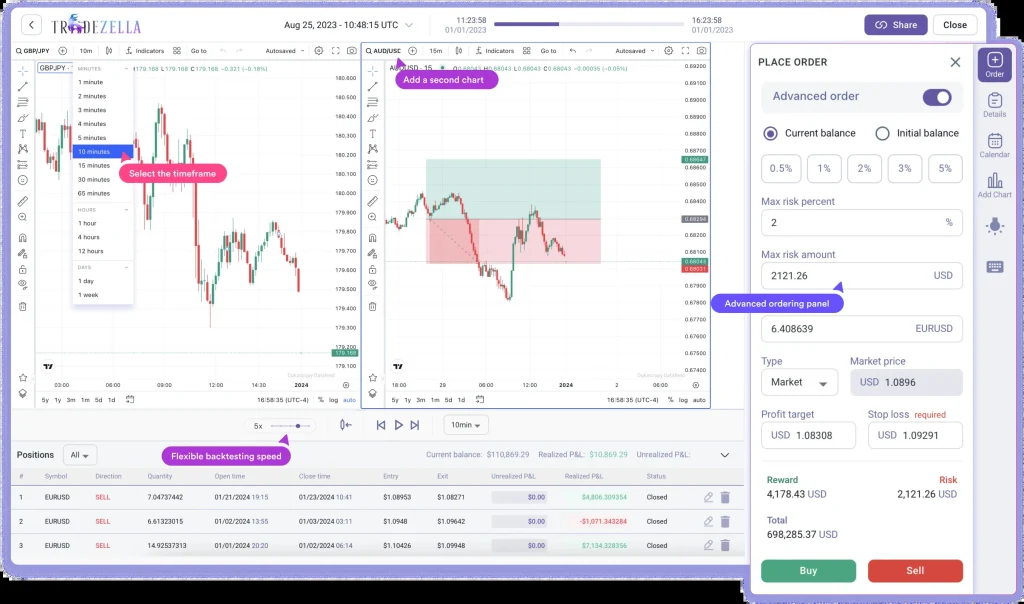

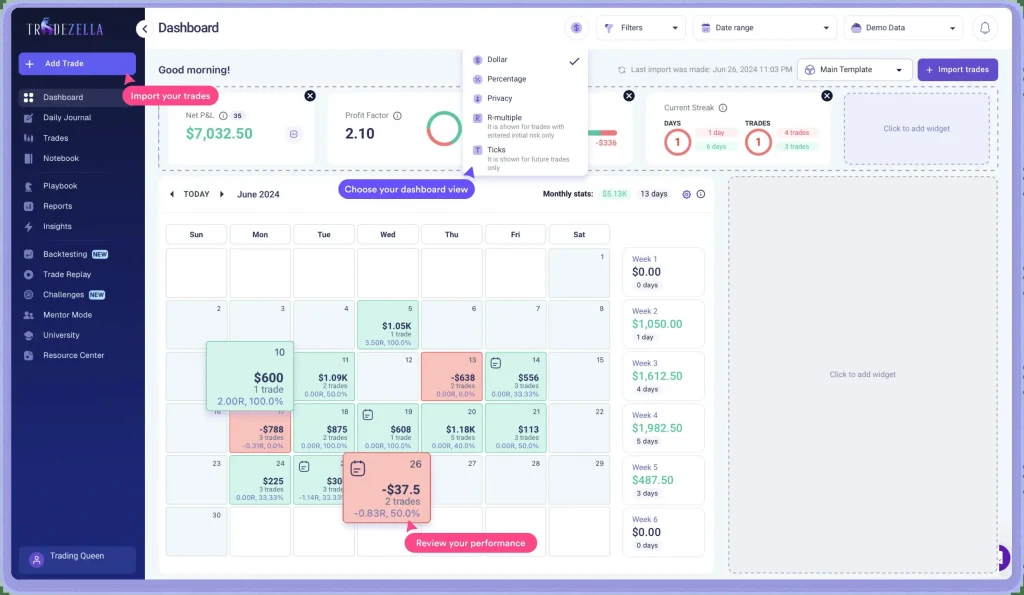

The software connects to popular brokerages, letting customers automatically import their trade data involving stock, futures, crypto, and foreign exchange transactions. Then, they can examine metrics to understand and plan trades around risk and reward, add their own notes to particular trades for future reference, or visually replay trades to fully understand how they performed and what the market was doing at the time. Customers can also use a backtesting feature to evaluate how potential trading strategies would have worked in the past, getting a sense of how profitable and risky they might be—and getting a sense of when it might make sense to apply them in the future.

“If you can go through the past four years of data with that one strategy now, when tomorrow or the next week that strategy presents itself, you’ve practiced enough for you to be able to read it in real time,” Ashraf says.

Traders who wish to swap strategies can take advantage of a “mentor mode,” which lets users give other people limited access to their training data to offer feedback. There’s also a set of webinars and instructional videos that the company calls Zella University, offering tips and advice about trading and using the software.

“Trading is an industry where someone can open up their account tomorrow, take a trade in the span of 10 minutes, and there’s no barrier of entry,” says Ashraf. “So people don’t know the proper things to do to treat trading like a business.”

The business was entirely bootstrapped and is now profitable (even employing two of Ashraf’s sisters), Ashraf says, offering basic plans advertised at $24 per month and premium plans with more features starting at $33 per month. The software development process has also gotten more refined over time, with more formal planning and coding sprints, and capacity to process feature requests from customers.

So far, Ashraf’s largely promoted the business through word of mouth and through his social media channels, including a YouTube channel where he posts trading advice videos to more than 750,000 subscribers and an X account that mixes trading maxims, TradeZella updates, and posts highlighting Ashraf’s success as he surprises one sister after another with luxury vehicles.

But while such posts might seem to inspire more adventurous trading, Ashraf says his company’s software can actually help traders better understand their risk profiles and, by reminding them of their missteps, help them avoid overly risky transactions.

“You know you’re gonna upload your trades to this platform, and you don’t want to have stupid trades, so psychologically, you’re going to be held accountable,” he says.

Inicia sesión para agregar comentarios

Otros mensajes en este grupo.

Look, I’m not gonna lie to ya’: I’ve got a bit of a love-hate relationship with PDFs. And, more often than not, it veers mostly toward the “hate” side of that spectrum.

Don’t get m

When the U.S. government signs contracts with private technology companies, the fine print rarely reaches the public. Palantir Technologies, however, has at

Bad news for morning routines everywhere: The New York Times has put its Mini Crossword behind a paywall.

On Tuesday, instead of their usual puzzle, players were met with a paywall. The

China’s Alibaba has developed a new chip that is more versatile than its older chips and is meant to serve a broader range of

Mount Fuji hasn’t erupted since 1707. But for Volcanic Disaster Preparedness Day, Japanes

When an influencer gets married, it’s safe to assume much of the cost, from venue decor to personalized invitations, has been comped in exchange for content. Now brides with smaller, more modest f