The night is young when Bilt Rewards founder and CEO Ankur Jain steps inside Manhattan’s ABC Cocina restaurant on a Monday in early spring. Vintage chandeliers glint overhead as the 35-year-old Jain, in jeans and sneakers, makes his way through the crowd, shaking hands, his winsome smile comfortably affixed. We’re here for a recurring comedy show that’s offered to members of Bilt, the loyalty program and payments platform for renters that Jain founded in 2019. As usual, the show sold out—through a combination of dollars and Bilt points—in minutes. As we find our seats, Jain disappears briefly, reemerging with martinis.

Over the next hour, a half dozen comedians take the stage to deliver their takes on politics, parenting, dating, and more. Jain joins in on the biggest laughs, slapping the table in approval. And when the evening’s final comedian takes a dig at Bilt itself, which has close to 5 million members and is valued at more than $3 billion, calling it a “cult” and suggesting that the audience rob its founder of his “billion dollars” that very night, Jain doesn’t flinch.

In a way, Bilt did start out as a cult—one aimed at credit card enthusiasts who collect points and miles with near-religious fervor. The startup first broke through with the Bilt Rewards Mastercard, which offers users rewards points for rent payments. The card launched to the public in March 2022 with a party at One Vanderbilt, Midtown Manhattan’s tallest skyscraper. Mayor Eric Adams attended and A$AP Rocky performed. Credit cards are a cutthroat business, but no one had ever tried securing a place in the wallets of affluent young professionals by focusing on rent, the biggest financial burden for many. (In the U.S., residential tenants pay $750 billion in rent each year.) Eighteen months later, Bilt had activated more than a million accounts and won over the kind of reward maximizers who treat The Points Guy blog as gospel. Brian Kelly, the “Points Guy” himself, is a Bilt investor.

Yet even as the card took off, Jain turned his attention to a much bigger prize. He began approaching property managers, proposing that they use Bilt to process rent payments. In exchange, Bilt would craft a loyalty program for their residents. Today, a growing number of apartment buildings require tenants to pay via Bilt, which operates a digital wallet that connects with whichever credit, debit, or ACH method tenants prefer. So far, Bilt is the exclusive payment-processing platform for 70% of the top 100 multifamily property owners in the U.S., covering roughly 25% of the multifamily rental market.

That’s why, despite the Bilt Rewards Mastercard’s buzzy reputation, Jain is quick to note that only 15% of Bilt’s rewards program members are cardholders. The vast majority simply sign up when they use Bilt’s platform to pay rent and earn points with each on-time payment. Bilt plans to further expand that model this year with the launch of a program that will give homeowners points for mortgage payments.

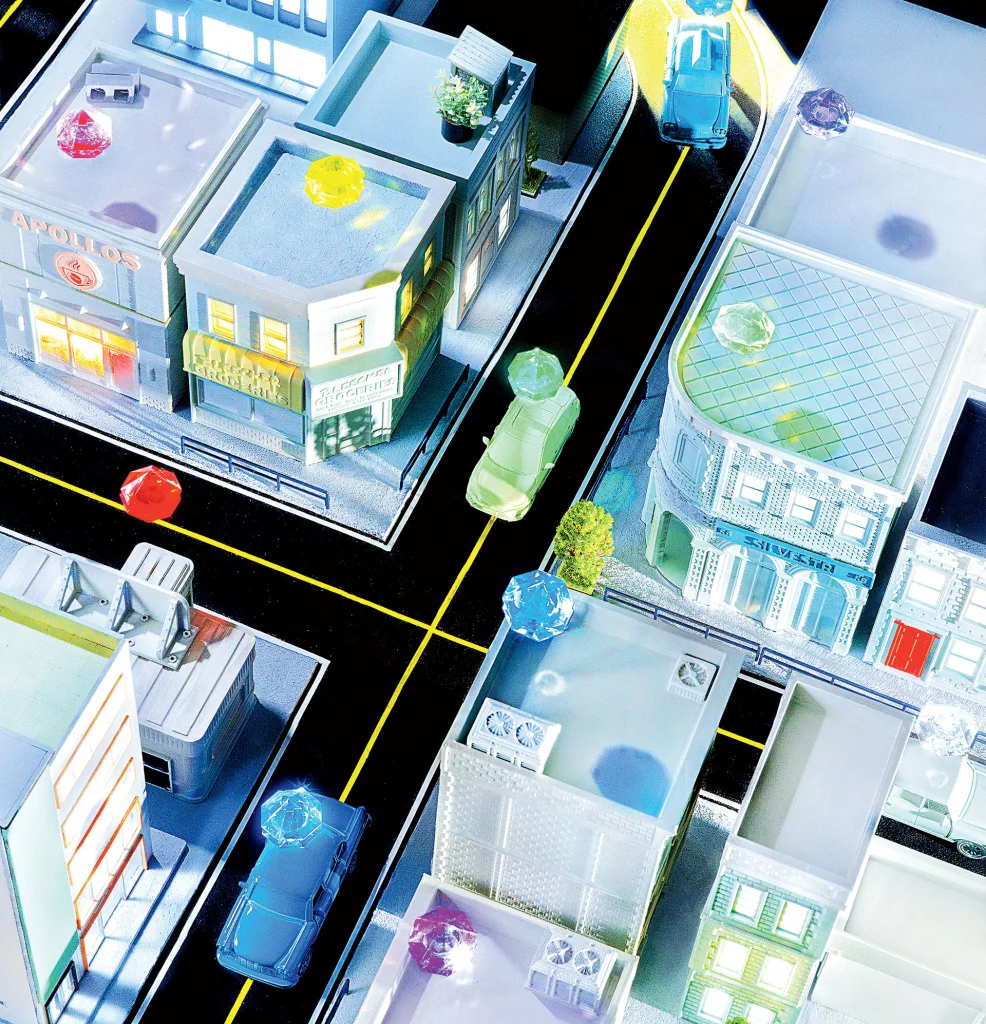

Now Jain is on his way to realizing the final piece of his vision. Through the digital wallet that members create when they sign up, he aims to make Bilt into a meta-level loyalty platform that touches just about every aspect of a user’s life. To enable that, he’s knit together a network of some 40,000 merchants—including fitness studios, restaurants, and major national brands such as United Airlines and Lyft—that allow members to earn and redeem Bilt points. To complete the circle, members can even put their points toward rent itself or a down payment on a home.

In the process, Bilt has found a clever way to layer itself over a large swath of local commerce. When a member dines out or breaks a sweat at one of Bilt’s merchant partners, Bilt charges the merchant a fee, using any cards loaded into the member’s digital wallet to prove attribution. (In the U.S., merchants pay a roughly 3% interchange fee for accepting credit cards, money that’s divided up among payments companies, with Bilt now among them.)

Jain’s plans caught the attention of former American Express CEO Kenneth Chenault, now a venture investor at General Catalyst. Chenault led Bilt’s $200 million fundraising round in January 2024 and became board chairman. “We want multiple cards to be on the Bilt platform,” he says. “Use the card that meets your needs for different spending categories, but use the Bilt platform for your spending.” According to Chenault, Bilt’s economics are “very, very attractive.”

Bilt made $200 million in revenue in 2024. It crossed $400 million in annual run rate in the first quarter of 2025, and expects to cross $1 billion in ARR by spring 2026. Its largest revenue stream derives from its business with property managers: Bilt takes a cut of the $36 billion-plus in annual rental payments that it’s currently processing and earns a commission for renewals that it helps to facilitate. Its second-largest revenue stream is its expanding merchant network.

Despite its growth, Bilt remains something of an enigma. Each of the individual pieces of its operations—rewards credit card, rental payment processor, local marketing platform, digital wallet—has been tried before with mixed success, or at great expense, by other companies. Bilt is the first to try them all at once. As Jain told leading fintech banker Steve McLaughlin during a fireside chat last year: “To pull this off, you have to figure out a model where everybody wins.”

In Bilt’s loyalty-based world, property managers and merchants win when Bilt delivers good tenants and customers. Members win when they get a free dessert at a local restaurant or book flights to a beach vacation with Bilt points. And Bilt, of course, wins by sitting at the center of all of these transactions. In a points-based economy, everybody can win. The fine print is that not everybody can win big.

Before he began offering renters lifestyle perks in exchange for on-time payments, Jain was focused on solving generational-scale challenges. Indeed, he’s been encouraging business leaders to tackle big markets with big problems since 2008, when he launched the nonprofit Kairos Society, a membership community for mission-driven entrepreneurs, while an undergraduate at the Wharton School at Penn.

During his freshman year, Jain sent 50 letters to executives, asking them to speak to his fledgling Kairos Society. He landed names including Boeing CEO Phil Condit and Virgin Group cofounder Richard Branson. Funded by Jain, the organization continued to operate after he graduated, hosting events that offered entrepreneurs a network of peers, access to people in power, and a heady shot of glitz. To kick off Kairos’s 2017 global summit, for example, Jain flew 200 dinner guests to the Hudson Valley’s Rockefeller Estate in Blade helicopters.

Jain’s father, Naveen, had also charted an entrepreneurial path, leaving Microsoft in 1996 to found web-services company InfoSpace. Naveen, who was born in a small village in India, made a fortune as InfoSpace’s market cap climbed to its peak of $31 billion in 2000. In 2002, when Jain was 12, Naveen lost control of the company following an accounting scandal and accusations of short-swing trading; he paid a $105 million settlement and denied liability.

Jain speaks of his father with admiration, and often repeats his business adages. But where Naveen navigated InfoSpace’s early days as a relative outsider, Jain has built his career around being the consummate insider. He attributes the inspiration for Bilt’s rewards model to Starwood Hotels and Resorts founder Barry Sternlicht, a regular dinner companion. He is grateful to NFL commissioner Roger Goodell, who is a Kairos adviser, for introducing him to Chenault. Those relationships paved the way for Bilt, Jain says. “Candidly, you’ve got to have the right platform, the right idea, the right time,” he adds. “But if you can’t call the CEOs of every major airline and hotel, how are you going to move quick enough to do this?”

Jain began circling around the right idea in 2019, a few years after he sold his digital Rolodex startup Humin to Tinder, where he stayed on and spent close to two years as VP of product. “The avocado toast is not what’s stopping us [millennials] from being able to afford a down payment on a home. We rent for, on average, seven years,” he told the host of AOL’s live-audience show Build at the time. “You’re lighting that money on fire every month.”

Bilt was just the germ of a concept. But Jain painted his vision with sweeping confidence. “Can we build a business model where that rent dollar actually goes toward your future home? So imagine that every single person in this country, just by renting, by the age of 28, 29, 30, has actually saved enough money to be able to afford the down payment on a home.”

At some point, however, Jain refined his world-changing mission. Instead of making home-buying more affordable, he’d make renting less onerous by plying renters with rewards from airlines and hotels. He’d also offer renters the chance to put rewards points toward a down payment—a benefit that’s welcome, but not substantial enough on its own, to turn a renter into a homeowner.

At first, prospective partners took Jain’s pitch calls but declined to make any kind of commitment. Property managers wanted to know who his rewards partners were, and airlines and hotels wanted to know which property managers had signed on. Jain realized he needed an elaborate growth hack to get Bilt off the ground.

Enter the Bilt Rewards credit card, which Jain describes as an “accelerant to reach customers directly.” When companies launch co-branded credit cards, they typically grow the products slowly so they can monitor cardholder behavior and ensure the economics work. Get the model wrong, and the cost of paying out a reward like 3% cash back can be dear. Bilt, in contrast, went all in, with headline-grabbing rewards including one-to-one points transfers with airlines such as United and Emirates and hotels like Hyatt and Hilton. On Reddit forums and blogs, points maximizers cheered.

“[Bilt] took value that existed [outside of] the points ecosystem and brought billions of dollars of value into consumer pockets,” says The Points Guy‘s Kelly. Bilt wasn’t necessarily restoring young renters’ faith in the American dream, but it was giving them freebies that made them feel good.

The runaway growth was a boon for Bilt but a potential challenge for Wells Fargo, Bilt’s issuing bank. Wells Fargo, which invested in Bilt in 2021, was losing as much as $10 million a month on the card deal, according to a Wall Street Journal report from last summer. Cardholders weren’t carrying balances at the rates the bank had expected. “Wells Fargo is not going to let them keep that deal forever,” says Matthew Goldman, founder of fintech consulting firm Totavi and publisher of CardsFTW, an industry newsletter. “The card is very, very pro-consumer, but to a fault. Rumor has it that they’re actively looking for a new card issuer, and no one’s very interested.” Bilt’s contract with Wells Fargo expires in 2029.

Jain declined to comment on whether Bilt is on the hunt for a new issuer. (Wells Fargo also declined Fast Company’s request for comment.) “It’s not our core business,” Jain says of the card. “Our job is to provide the best rewards ecosystem, the best commerce platform, the best [customer] acquisition, the best brand, so that our partners can create a great card product around it.” In other words, the economics of the card are the issuer’s problem. Jain doesn’t have plans to drop the Bilt card, but going forward, he imagines it occupying a relatively modest place in Bilt’s overall strategy.

Loyalty programs, after all, are a booming business—and one that extends far beyond credit cards. Restaurants like Chipotle, Crumbl, McDonald’s, and Starbucks run app-based loyalty programs. Sephora woos its members with early access to new products and the opportunity to exchange points for beauty samples. PlayStation’s loyalty program doles out digital collectibles.

“Rewards are eating the world,” says Kelley Halpin, cofounder and CEO of Mesa, a newly launched loyalty program for homeowners that grants points for mortgage payments. The proliferation of loyalty programs, Halpin says, means that “people expect more value back.”

But they are also suffering from loyalty fatigue. The average U.S. household belongs to 29 programs, according to a 2017 Accenture analysis. Bilt sees that fatigue as an opportunity to create a streamlined umbrella program, but it will have to stand out. Luckily for Jain, by working with property managers, he’s found a captive audience.

The morning after the comedy show, I meet Jain for coffee at Bilt’s NoHo offices on Bond Street in New York City. Bilt operates a small café on the ground floor and uses the space for one of its recurring monthly “Rent Day” promotions: free coffee, paired with a breakfast treat.

In a clever inversion of the day’s gloomy psychology, Bilt has transformed the first of the month into an opportunity to drive “earn and burn,” as the loyalty industry puts it. Pay your rent on time, and on rent day, Bilt showers you with extra rewards, like 50% transfer bonuses with airline partners and special giveaways, including the chance to win a month of free rent. On April 1, New York City–based Bilt members lined up for coffee and everything bagels from PopUp Bagels while a DJ in sunglasses and a silver chain spun club tracks from behind the counter.

The Rent Day promotion is the perfect encapsulation of Jain’s win-win-win approach to Bilt’s network. Bilt’s linking of on-time payments to deals and rewards encourages tenant compliance. Merchant partners get a dedicated opportunity to introduce themselves to tenants. And members get a glimpse of the credit-based rewards lifestyle. “Some people really love aspirational travel,” Jain says as we settle into a meeting room, and “some people only care about everyday utility.” Bilt aims to serve them all.

Jain, sipping a chocolate protein shake, opens his laptop and leans back in his armchair. He wants to demonstrate the tools that have pulled property managers into the Bilt Alliance. “If you’re in a housing space and you don’t have Bilt, you’re behind,” he says, linking his laptop to the presentation screen at the front of the room.

Jain logs in as if he were a property manager looking to improve renewal rates. Depending on the market, roughly 40% of renters move out each year. Landlords are always looking for ways to convince tenants to stay or to at least give advance notice of their departures. Until Bilt, most relied on a combination of rent discounts and gift cards. Bilt says that properties that use its tools have seen a 20% boost in early renewals.

“I’m a big believer of, fit into the boxes people already understand,” Jain says as he pulls up a screen with fields that allow landlords to set an audience for a renewal campaign. Today, he says, imagine that “we’re offering half a month of rent if you renew 30 days early.” He selects a region and property type, sets a rent ceiling, and launches the campaign. “Based on the building [and] the customer profile, we generate a personalized offer.”

If this were a real campaign, Bilt would present each resident with a choice: If they renew 30 days early, they can choose between half a month of free rent or what Bilt deems to be the equivalent, plus a smidge more, in rewards points and promotions. A tenant paying $3,000 in rent might see an offer for $1,500 cash or some combination of Bilt points, partner points, and merchant offers. At their best redemption value, Bilt points are on par with those of market leaders like Chase and American Express.

But the street value of a Bilt point can still vary substantially, from about 1.5 cents per point for rent redemption to 0.7 cents for Lyft rides. Six months into launching the feature, Jain says, just under half of tenants are picking the rewards over the cash. “I think that number will go up,” he says.

Building features at the behest of property managers has helped Bilt win over some of the largest landlords in the country. Bilt Alliance customers include Douglas Elliman Real Estate, Equity Residential, GID, Greystar, Morgan Properties, and Related—all of which have also invested in Bilt. Their lease marketing budgets, which Bilt is starting to capture, can be in the hundreds of millions of dollars. “If you look back at the apartment industry over 25 years, we knew less about our customers than a lot of other industries do,” says Greg Bates, GID president and CEO. “They apply. We get their credit report. They live with us.”

Bilt changes all that. “The Bilt program gives us access to a ton of information on how [residents] spend their time and how they spend their money,” Bates says. “What do they value in the community, in terms of local merchants or restaurants? Are they using Bilt rewards for dog walkers? Because the more we understand someone and what they value, the better products we can offer people.” During the leasing process today, rewards can even function as an amenity and help make up for a property’s shortfalls. No resident gym? Bilt deals at SoulCycle can help fill the gap.

Some property technology investors eyeing Bilt’s rise from the sidelines wonder whether being part of the Bilt Alliance will lose its allure as more properties join the club. But Bilt’s partners say they see ubiquity as an asset. “We manage 220,000 units,” says Margette Hepfner, chief operating officer for residential management at Dallas-based Willow Bridge Property Company. “That’s a lot, but we’ve never been able to build a loyalty program for renters. Not one of us owns or operates enough real estate that we can build our own loyalty brand.”

Connectez-vous pour ajouter un commentaire

Autres messages de ce groupe

Did you wake up at 4 a.m. on November 6, 2024? If so, you’re not alone.

The 4 a.m. club is a group of people, mostly on TikTok, who say they were spiritually “activated” when they

New analysis has found mobile phone users are being pinged with as many as 50 news alerts daily. Unsurprisingly, many are experiencing “alert fatigue.”

The use of news alerts on phones h

The startup Warp is best known for its modern, AI-empowered take on the terminal—the decades-old,

Want to save pages on the web for later? You could always bookmark them in your browser of choice, of course. But that’s a quick way to end up with a messy bookmarks toolbar. And organizing your b

When a viral Reddit post revealed that ChatGPT cured a five-year medical mystery in seconds, even LinkedIn’s Reid Hoffman took notice. Now, OpenAI’s Sam Altman says Gen Z and Millennials are treat

Everyone who’s ever talked to ChatGPT, Claude, Gemini, and other big-name chatbots recognizes how anodyne they can be. Because these conversational AIs’ creators stuff them with as much human-gene

Robinhood was under fire after the GameStop controversy in 2021. But last year, it posted its strongest results ever. FC Explains how Robinhood rebuilt trust, launched powerful tools, and made a m