There is now a regular deluge of new studies showing the potential widespread health benefits of GLP-1s, the class of drugs that encompasses diabetes and obesity treatments like Novo Nordisk’s Wegovy and Ozempic (which contain the active ingredient semaglutide) and Eli Lilly’s Zepbound and Mounjaro (active ingredient tirzepatide). From weight loss in obese patients, to protecting heart and cardiovascular health outcomes, to lowering blood pressure, combating fatty liver disease, and potentially even providing a boost to the brain that can gird against mental health and neurological conditions such as Alzheimer’s disease, anxiety, bipolar disorder, and depression, early clinical and academic studies suggest GLP-1s and related drug classes could transform the health of millions–and Novo and Lilly aren’t the only players jockeying for a plum perch in this explosive pharmaceutical arena.

The two drug giants have dominated the conversation–and market–to date as pioneers in the space. Mounjaro and Zepbound raked in more than $5.3 billion in 2023 revenues for Eli Lilly while Ozempic and Wegovy landed $18.4 billion in Novo sales last year–and the weight loss-specific Zepbound was only on the market for the final quarter of 2023. But the two drug giants that were first out of the gate with such products realistically can’t be the only kids on this biological block given the market’s sheer scope and evolving science on different types of GLP-1 class drugs, according to experts.

“Right now, Lilly and Novo are in the lead with Wegovvy and Zepound approved and taking up market share. But I wouldn’t characterize it as just Lilly versus Novo because the market is so big you actually need both players to satisfy demand,” Evan Seigerman, managing director and senior research analyst covering biotech and pharmaceuticals at BMO Capital Markets, tells Fast Company.

“We hear a lot about manufacturing, kind of, bottlenecks. I know there are a lot of other players kind of trying to figure out their angle in, and I think that you need something different than just a once-weekly GLP-1, or even a once-weekly dual agonist like tirzepatide.” (Eli Lilly’s tirzepatide is something called a GLP-1 dual agonist, scientifically, that targets another type of receptor protein on top of GLP-1 while Novo Nordisk’s semaglutide targets only GLP-1).

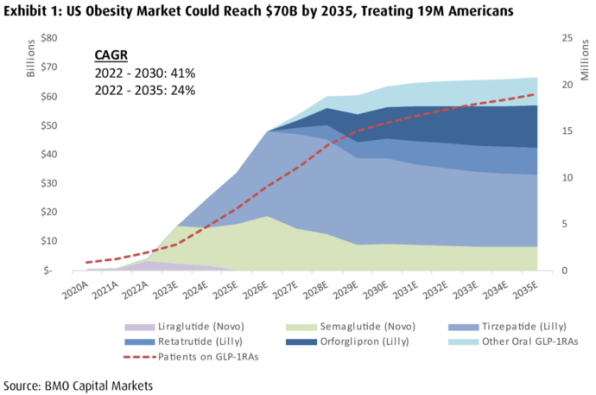

The potential market size for obesity and the many kinds of health conditions linked to it numbers in the tens of millions in the U.S. alone. In an extensive BMO Capital Markets report from last September, Seigerman and his research team projected the size of the obesity drug market to balloon to $70 billion in just over a decade. And that was before Lilly’s Zepbound FDA approval last November. That version of tirzepatide is approved for chronic weight management in obesity patients specifically while Mounjaro is approved for type 2 diabetes (similar to the difference between Novo’s weight loss semaglutide formulation versus its diabetes-indicated Ozempic). Other analysts such as researchers from JPMorgan predict the global market for obesity drugs could reach $71 billion by 2032. There were 46.5 million U.S. prescriptions dispensed for GLP-1 class drugs for diabetes and obesity in 2023 alone, according to data the intelligence firm IQVIA emailed to Fast Company.

It’s no surprise that meeting the soaring demand and even greater market potential for these medicines isn’t possible for two companies alone. The rush for more patients, manufacturing backlogs, and competitors who want to develop the next generations of GLP-1 products that might be even more effective, or more convenient, or have more far-reaching uses, significantly expands the lucrative GLP-1 playing field.

The competition might also be necessary to relieve patients’ costs for the pricey treatments. Wegovy carries a list price of about $1,080 per month without insurance or patient assistance while Ozempic costs $936, for instance. Furthermore, 60% of GLP-1 prescriptions remained unfilled through the second half of 2023, according to medical claims data analysis from IQVIA, and the companies and World Health Organization (WHO) have warned of protracted shortages for the drugs still most commonly used by Type 2 diabetes patients in the near future. On February 5, Novo Nordisk’s parent company Novo Holdings announced a $16.5 billion deal to buy New Jersey-based drug contract manufacturer Catalent to beef up its manufacturing capacity for Wegovy and Ozempic.

The combination of resource constraints and thirst for newer, more beneficial products is likely to keep this industry arms race going for years to come. “You need something that: a) has a better tolerability profile; b) better weight loss; c) less frequent dosing; and d) potentially an oral pill GLP-1 formulation rather than an injection. I think that’s where we’re going, come up with better versions of what we have,” says BMO’s Seigerman. He points to lesser known companies such as Viking Therapeutics, which is testing an experimental oral GLP-1 for obesity and metabolic disorders, and Structure Therapeutics, which also has a GLP-1 oral pill in-development that’s shown early promise in slashing blood sugar and cutting weight.

Lilly and Novo are forging ahead with their own next-gen GLP-1 efforts, too. “Lily’s not stopping at tirzepatide, they also have orforglipron which an oral GLP-1, and retatrutide or ‘Triple G’ as they call it which is a triple agonist,” said Seigerman. “And, you know, Novo’s doing the same with some of their combinations because the goal ultimately is better, more sustained weight loss, better quality of weight loss, balancing weight loss without causing muscle mass loss.”

There are 486 active studies of GLP-1 drugs and their effects on various types of patients and diseases currently listed in the federal ClinicalTrials.gov database.

Melden Sie sich an, um einen Kommentar hinzuzufügen

Andere Beiträge in dieser Gruppe

A “click-to-cancel” rule, which would have required busines

Yesterday, Apple unexpectedly announced the most radical shakeup to its C-suite in years. The company revealed that Jeff Williams, its current chief operating officer (COO), will be departing the

As Congress moves to make massive cuts to public broadcasting this week, Paula Kerger, president and CEO of the Public Broadcasting Service (PBS), gives an unflinching look at the organization’s f

Just over a month ago, Samsung did something strange to start hyping up its next foldable phone announcements.

Those phones, which Samsung revealed today, are officially called the Samsu