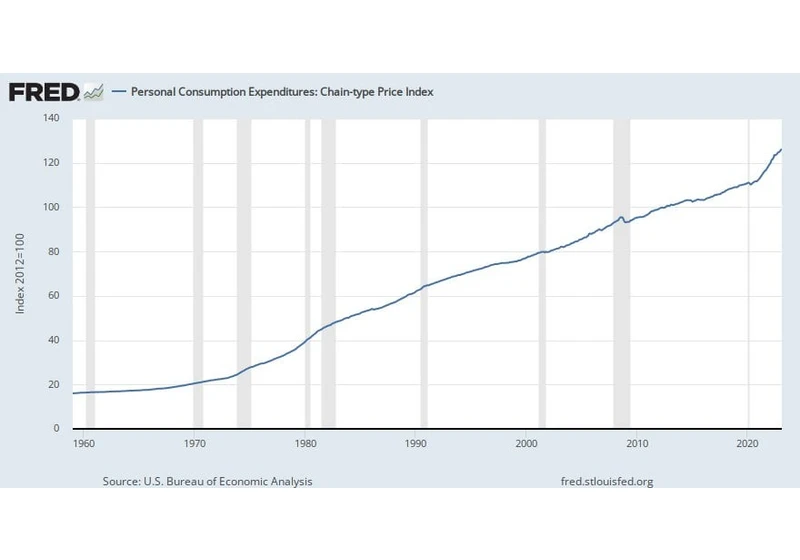

I don't think people get this. The inflation has been so bad over the past couple years, that our 10-year annualized average has been 2.2358%. (And for what it's worth, the previous 10-year span was 2.1% annualized, so still not 2.0%.)

In order to average a 2.0% inflation rate across 15 years (the previous 10 plus the next 5), we'd have to get inflation to an annualized 1.54% for the next 5 years. If we allowed ourselves the next decade to bri

22 y/o, I just got my worker 401k from my employer set up. I was seeing what all I could buy in it but I'm not too familiar with the options. If I could I would love to have everything that goes in there go to VOO but it's not an option. I know I should probably talk to a financial advisor about this, which I am, I just want to see what some of you redditors think.

American Funds 2065 Target Date-R3 * Af U.S. Government Money Market-R3 * Amcap Fu

What kind of software do small investment firms use? Do they use their own software? If yes, how do they manage to develop their own software?

How about larger ones? What kind of software do they use? Or do they just go directly to the floor?

Contributing to a Roth IRA just requires depositing cash into it. That cash could be invested immediately into say a Target Retirement Date Fund or SPY, but you can also just store it as a money market mutual fund, bond ETF, etc. In Vanguard, for instance, you can either immediately store it in the 'Settlement Fund,' which is a money market mutual fund (VMFXX) currently earning 4.5% interest, or you can put it in one of the mutual funds you opened with V

Consensus for March 2023 YoY CPI is expected to be 5.2%. This shows a significant downtrend from the prior month reading of 6.0% and from the high of 9.1% in June 2022. This would be the lowest YoY CPI reading since May 2021. Of course, the Fed favors core PCE but this is still a good sign fo

If a significant portion of knowledge workers become obsolete due to massive automation, will the stock market crash? I've been keeping up with the rapid pace of AI advancements and I really don't think society is prepared for a world where a significant number of people are displaced and completely unneeded. It's kind of bizarre to me that there isn't more planning for this situation.

Say the fund goes up 10% and you want that 10% profit, is your only option to sell the lot, the other option would be to sell 10% or so of your stock but that will start to reduce your overall stick volume.

In crypto project you get paid rewards etc which you can just cash out without affecting the initial deposit but in stocks you can't do that.

So with stocks like index funds do you generally wait longer term then cash out the lot so it not

Good morning everyone! I have a very quick question. If you’re 26, and beginning to invest for your financial future, do you go primarily in VOO, SPY, BRKB, or a mixture of the 3 to hold for 30 years? Any and all advice / recommendations are more than welcomed!!

The meme stock scheduled posts will now run weekly and post Saturday afternoon and won't be a sticky; you're probably seeing this because automod sent you here!

Full list of meme stocks here. This will be updated every once in a while.

Welcome traders who just can't help them selves discuss the same exact stock that's been discussed 100s of times a day. I get it, y

I was looking at the earnings summaries for Exxon and I found that while it earned $400B in revenue for 2022, it only got about $100B in revenues from oil and gas. Where does the other revenue come from?

[link]